VAT refund

International VAT refund

A company that are established in one country, but receive supplies in another country may be able to refund the VAT charged from that transaction. The required procedure is depending on the location of establishment and transaction. For instance, the application process inside EU is different from Non-EU.

Typical expenses eligible for reimbursement are:

- Local purchases

- Passenger transportation

- Trainings & seminars

- Exhibitions

- Travel & Entertainment (T&E) expenses

continues changes in legislation

Rules and regulations may vary from country to country, and are continuously changing. Therefore, AVAT keeps you informed about current requirements and are submitting your refund applications according to valid legislation in each country.

Refund from T&E expenses

Vat refund from T&E is time consuming. Firstly, it requires dedicated resources. Secondly, you neet to obtain detailed knowledge about local VAT legislation in each country. As a result, many companies does not utilise the opportunity to recover VAT from these expenses. Often there are many small transactions from several different countries. However, all these small transactions add up. For this reason, MomsPartner offer a VAT refund service that is easy, fast and affordable.

Safe refund process

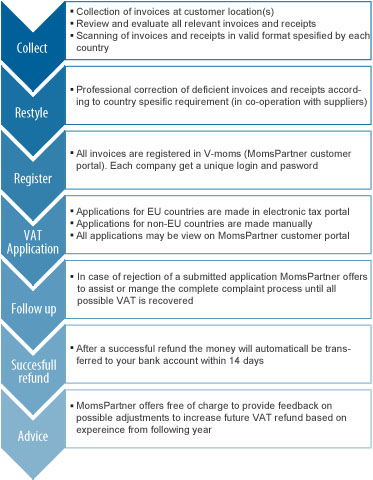

AVAT is dedicated to make VAT refund feel safe as easy. Therefor, we offer a premium service where we manage the complete process. In other words, we assist with everything from collecting and evaluating invoices until a successful refund is completed. In addition, we keep you informed during the complete process.

Frequently asked questions

Q: Who can apply for VAT refund?

A business registered for VAT in one EU member state can reclaim VAT incurred in another member state. However, it should be done according to local VAT legislation. In addition, it is important to determine, if this transaction or any other transaction during this period is considered to be a taxable supply. In such case, the company is eligible to register for VAT.

Q: When can I not apply for VAT refund?

A company registered for VAT in one EU member state can reclaim VAT incurred in another member state. However, if the company is already registered or eligible to register for VAT purposes in a particular member state, it should register in that country. After that, VAT shall be recovered through its regular VAT reporting (periodic returns). Applications to recover VAT under Directive 2008/09/EC will be rejected if the business has its residence, its seat or a fixed establishment and/or taxable supplies of goods or services in the EU member state in which the VAT was incurred.

Q: In what country may I apply?

You may apply for VAT refund from all 28 EU member states and from countries, which are member of the European Free Trade Association (EFTA) – Iceland, Norway and Switzerland. VAT recovery is also possible from other countries, where there is in place a reciprocity arrangement (e.g. South Korea).

Q: Can I apply myself?

Yes, but you need to be familiar with the local VAT legislation from relevant country. In addition, it is important to consider if VAT from this transaction, or any other transaction during this period, is considered to be a taxable supply. In this, case the company is eligible to register for VAT.

Q: How do I apply inside EU

Companies established inside EU shall apply according EU Directive 2008/09/EC, that became effective on 1 January 2010. For instance, they introduced a new procedure for businesses established and registered for VAT purposes within the EU when requesting a refund of VAT incurred in other EU countries. In addition, they introduced an electronic tax portal to be used for submitting refund applications and communicating with tax office.

Q: How do I apply from non-EU?

Companies established in none-eu countries shall apply according to the 13th directive. For this reason the refund procedure is significant different from companies establish in EU. For instance, the refund application is submitted manually in paper form together with proper documentation directly to relevant tax office. After that, all communication will be done by letter sent by mail.

Q: What cost may I apply for?

MomsPartner is specialised in VAT refund. More information comes later

-

smart

No hidden cost or fees! We only charge commission from successful refund.

-

easy communication

We keep you continiously updated during each step of process

-

fast & easy

We offer to manage the complete process. No additional work for you.

-

competence

We specialise in VAT legislations and communication with foreign tax offices.

-

personal service

We offer great service through personal contact and follow up.

-

problem solving

Our experts are always prepared to assist you at solving your challenges.

VAT refund transportation

Special offer in February

VAT redund from fuel card

VAT on expenses from fuel and road tax may be reimbursed from many countries. This often depends on the local legislation and your type of car. MomsPartner offer to help to reclaim your VAT in an easy and affordable way from the following

- Receipts

- Invoices (fuel card)

- Road tax

- Other car cost

Contact us to learn more about our competitive prices and services.